Written By: MB Group

In mid-August, President Joe Biden signed into law the Inflation Reduction Act of 2022 which is primarily centered around healthcare, green energy and climate with key tax provisions, including:

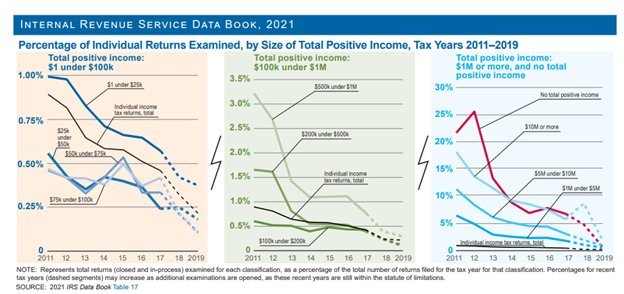

Most notably, the Inflation Act also provides almost $80 billion in additional funding to the IRS to be used for a variety of purposes such as system modernization, tax court, operations support, taxpayer services and enforcement. Many clients have reached out to us with concerns regarding the widespread news reports that the IRS will be hiring 87,000 agents and that audit rates will be on the rise. While on the surface, this information seems quite alarming, it’s important to know that the additional agents will be hired over a 10-year period to replace 50,000 agents that are slated to retire. Further, IRS audits have been decreasing steadily over the course of the last decade as shown in the below graphs excerpted from the 2021 IRS Data Book (https://www.irs.gov/pub/irs-pdf/p55b.pdf).

We are optimistic that funding to the IRS will result in improved technology, better agent education/training or and more resources that will enable accounting professionals to resolve client tax issues more effectively and efficiently.

Expanded Research Credit for Small Businesses

In tax years beginning after 2015, certain qualified small businesses are allowed to claim a limited amount of the research credit against payroll taxes. Under the Inflation Reduction Act of 2022, in tax years beginning after 2022, the maximum amount of the credit against payroll taxes is increased from $250,000 to $500,000.

Taxpayers may be able to claim a credit for qualified research expenses. The research credit comprises three separately calculated credits: (1) the incremental research credit, (2) the credit for basic research payments to universities and other qualified organizations, and (3) the credit for energy consortium payments. A qualified small business may elect to apply a portion of its research credit against the social security tax imposed on an employer’s wage payments to employees.

A qualified small business must satisfy the following tests:

Extended & Modified Electric Vehicle Credits

The 2022 Inflation Act includes extension and modification to tax credits for clean vehicles. The credit for the purchase of new clean vehicles (which includes both plug-in electric vehicles and fuel cell vehicles) is extended through 2032, and modified, under the 2022 Inflation Act. The 2022 Inflation Act eliminates the current credit’s limitation on the number of vehicles produced by a specific manufacturer.

New Clean Vehicle Credit

.png?width=300&name=Untitled%20design%20(77).png)

The credit for new qualified plug-in electric drive motor vehicle credit is restructured as a maximum credit of $7,500 for a new clean vehicle. The new clean vehicle credit generally applies to vehicles placed in service after December 31, 2022. Only one credit is allowed once with respect to any vehicle, as determined based on its vehicle identification number (VIN), including any vehicle with respect to which the taxpayer elects to transfer the credit to an eligible entity.

The credit imposes sourcing requirements on the critical components of the vehicle and battery systems. The maximum amount of the credit remains at $7,500, but includes income limitations, as well as limitations on the manufacturer’s suggested retail price.

AGI and Price Caps

The threshold amounts are:

The credit also is not allowed if the manufacturer’s suggested retail price (MSRP) for the vehicle exceeds:

Credit Amount

The new clean vehicle credit has two components:

Previously Owned Clean Vehicle Credit

A tax credit of up to $4,000 is available for the purchase of certain used clean vehicles. A qualified buyer who places in service a previously owned clean vehicle during a tax is allowed as a credit the lesser of:

The credit is not allowed if the lesser of the taxpayer's modified adjusted gross income for the tax year or the preceding tax year exceeds $75,000 ($150,000 for married couples filing jointly and $112,500 for head of household filers).

A “previously owned clean vehicle” is a motor vehicle whose model year is at least two years earlier than the calendar year in which the taxpayer acquires the vehicle. It must have been used originally by a person other than the taxpayer. The taxpayer must have acquired the vehicle in a qualified sale. The vehicle must have a gross vehicle weight rating less than 14,000 pounds.

A qualified sale is a sale of a motor vehicle by a dealer for a sale price that does not exceed $25,000. The sale must be to a qualified buyer. The sale must be the first transfer since the date the enactment of this provision. The sale may not be to the original user of the vehicle.

The qualified commercial clean vehicle credit for any tax year is an amount equal to the sum of the credit amounts determined with respect to each qualified commercial clean vehicle placed in service by the taxpayer during the tax year.

Per vehicle amount

The credit amount is equal to the lesser of:

The amount is limited to $7,500 for a vehicle having a gross vehicle weight rating of less than 14,000 pounds, and $40,000 for other vehicles. A qualified commercial clean vehicle’s incremental cost is the excess of the vehicle’s purchase price over the price of a comparable vehicle. A comparable vehicle is any vehicle powered solely by a gasoline or diesel internal combustion engine and comparable in size and use to the vehicle.

New Energy Efficient Home Credit

The Inflation Reduction Act of 2022 (2022 Inflation Act) extends the New Energy Efficient Home Credit through 2032, in addition to increasing and modifying energy-saving requirements effective for dwelling units acquired after December 31, 2022.

Extension of credit

The credit is extended for 11 years, through December 31, 2032.

-1.png?width=312&name=Untitled%20design%20(78)-1.png)

Energy-saving requirements

The 2022 Inflation Act modifies the energy-saving requirements that must be met to qualify for the credit, including requirements for:

Credit amounts

Additionally, the 2022 Inflation Act replaces the existing credit amounts with a $2,500 credit for new single-family homes that meet certain energy efficiency standards and a $5,000 credit for new single-family homes that are certified as zero-energy ready homes.

The credit for multifamily dwelling units is set at $500, or $1,000 for eligible multifamily units certified as zero-energy ready. Additionally, an enhanced bonus credit is available with respect to multifamily housing units if taxpayers satisfy prevailing wage requirements for the duration of the construction of such units.

The bonus credit is equal to $2,500, or $5,000 for units that are certified as zero-energy ready.

Basis adjustment

Further, the 2022 Inflation Act clarifies that taxpayers claiming the credit do not have to reduce basis for purposes of calculating the low-income housing tax credit.

Modified & Extended Homeowner Energy Credits

The Inflation Reduction Act of 2022 (2022 Inflation Act) modifies and extends both the nonbusiness energy property credit and the residential energy efficient property credit available to individual homeowners.

Energy Efficient Home Improvement Credit

The 2022 Inflation Act extends the nonbusiness energy property credit to property placed in service before the end of 2032 and renames the credit the “Energy Efficient Home Improvement Credit.” The nonrefundable tax credit is available to individuals for the installation of:

The 2022 Inflation Act also modifies the credit by:

Residential Clean Energy Credit

The 2022 Inflation Act extends the residential energy efficient property credit to eligible property placed in service on or before December 31, 2034 and renames the credit the “Residential Clean Energy Credit.” The residential clean energy credit may be claimed for qualified residential energy efficient property installed on, or in connection with, a dwelling unit located in the United States and used as a residence by the taxpayer. Qualified residential clean energy property includes solar electric property, solar water heating property, fuel cell property, small wind energy property, geothermal heat pump property, and for expenditures incurred after 2020, biomass fuel property.

The 2022 Inflation Act allows for a 30% credit for eligible expenditures through the end of 2032, then phases down to 26% in 2033 and 22% in 2034. Qualified expenditures for battery storage technology are eligible for the credit beginning after 2022, while qualified expenditures for biomass fuel property are not eligible for the credit after 2021.

Extended Health Insurance Premium Assistance Credit

The Inflation Reduction Act of 2022 (2022 Inflation Act) extends the popular Affordable Care Act premium reductions. The 2022 Inflation Act extends the affordability percentages used in calculating the premium tax credit to make credits available for individuals with income above 400 percent of the federal poverty line, as well as increases the credit amounts for those already qualified through tax year 2025.

-2.png?width=273&name=Untitled%20design%20(79)-2.png)

For Tax year 2021 and 2022

The American Rescue Plan expands eligibility to individuals with household income in excess of 400 percent of the poverty line and increases the credit amounts for those who qualify. In addition, for 2021, the American Rescue Plan makes advance premium tax credits available for individuals receiving unemployment compensation.

Background

The premium tax credit – also known as PTC – is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace. You are eligible for the premium tax credit if you meet several requirements, including:

Individuals who apply for coverage in the Health Insurance Marketplace, estimate their expected income for the year. The amount of the premium tax credit is determined based on this estimate and is used in advance to lower the premium payment. However, if at the end of the year the advanced premium tax credit is more than you should have received based on your final income, the excess is reconciled and paid with your federal tax return. If you’ve taken less than you qualify for, you are eligible for the difference.

The affordability percentages used to calculate the premium tax credits for 2021 and 2022 are extended to be in effect from December 31, 2020, and before January 1, 2026. Likewise, the rule to allow the credit to taxpayers whose household income exceeds 400 percent of the poverty line is extended through 2025.

Energy Efficient Commercial Buildings Deduction

The Inflation Reduction Act of 2022 (2022 Inflation Act) modifies the energy efficient commercial buildings deduction for tax years beginning after December 31, 2022, by increasing the maximum deduction and updating the eligibility requirements for reduction of energy costs, in addition to other changes.

Energy efficient commercial buildings deduction

A deduction is allowed for all or part of the cost of energy efficient commercial building property placed in service as part of a building's:

The deduction was enacted to encourage commercial building owners or lessees to install energy efficient property. Installation of energy-efficient commercial building property occurs when constructing a new, or improving an existing, commercial building or government building. The tax deduction benefits both commercial building owners or lessees and designers of government-owned buildings.

Efficiency standard

The 2022 Inflation Act updates eligibility requirements for the deduction so that property must reduce associated energy costs by 25% or more (decreased from 50% or more) in comparison to a reference building that meets the latest efficiency standard.

Applicable amount

The applicable dollar value of the deduction is $0.50 per square foot, increased by $0.02 for each percentage point above 25% that a building’s total annual energy cost savings are increased. The amount cannot be greater than $1.00 per square foot. However, the maximum amount of the deduction in any tax year cannot exceed $1 per square foot minus the total deductions taken in the previous three tax years (or during a four-year period in cases where the deduction is allowable for someone other than the taxpayer). The applicable dollar value will be adjusted for inflation for tax years beginning after 2022.

An increased dollar value is available for projects that satisfy prevailing wage and apprenticeship requirements for the duration of the construction.

Alternative deduction for energy-efficient retrofit property

Under the 2022 Inflation Act, taxpayers may elect to take an alternative deduction for a qualified retrofit of any qualified property. However, instead of a reduction in total annual energy power costs, the deduction is based on the reduction of energy usage intensity.

New Corporate Alternative Minimum Tax

The Inflation Reduction Act of 2022 (2022 Inflation Act) enacts a 15-percent corporate alternative minimum tax (AMT) for large corporations.

For tax years beginning after 2022, a 15-percent corporate AMT is imposed on the adjusted financial statement income of an applicable corporation with a three-year average annual income in excess of $1 billion. To determine if this threshold is met, corporations under common control are generally aggregated and special rules apply in the case of foreign-parented corporations. The corporate AMT does not apply to S corporations, regulated investment companies, and real estate investment trusts.

A corporation’s adjusted financial statement income is the net income or loss reported on the corporation’s applicable financial statement with adjustments for certain items. Special rules apply in the case of related corporations included on a consolidated financial statement or filing a consolidated return. Applicable corporations are allowed to deduct financial statement net operating losses, subject to limitation, and can reduce their minimum tax by the AMT foreign tax credit and the BEAT tax. They can also utilize a minimum tax credit against their regular tax and the general business credit.

Background

Corporations are subject to a 21-percent income tax on their taxable income. However, corporate taxpayers with significant income may reduce the effective income tax rate and even completely avoid paying income tax by utilizing deductions, exemptions, losses, and tax credits. To prevent corporations from paying little or no tax, a corporate AMT applied to tax years beginning before 2018. The corporate AMT required the recomputation of a taxpayer’s regular taxable income, which was modified by certain AMT tax preference items and various AMT adjustments. These preference items and adjustments generally involved alterations to various deductions or exclusions allowed in computing regular taxable income. In essence, the corporate AMT recaptured some of the benefits provided by these tax breaks. The corporate AMT was repealed for tax years beginning after 2017 by the Tax Cuts and Jobs Act.

Alternative Minimum Tax on Large Corporations

The AMT of an applicable corporation is equal to the excess (if any) of:

Thus, the new AMT on applicable corporations is reduced by the BEAT liability of the corporation for the year.

The tentative minimum tax of an applicable corporation for a tax year is the excess of:

In the case of any corporation that is not an applicable corporation, the tentative minimum tax for the tax year is zero.

Applicable corporation

An applicable corporation with respect to any tax year is a corporation (other than an S corporation, regulated investment company (RIC), or real estate investment trust (REIT) that meets an average annual adjusted financial statement income test for one or more tax years before the current year and ends after December 31, 2021. Under the test, a corporation is an applicable corporation for AMT purposes if:

Please call our office for more information as to how the 2022 Inflation Act will impact your tax situation.

Tags: Taxes

Happy Thanksgiving! During this special season, we’ve been thinking a lot about all the things we’re grateful for here at MBG…and it was a really long list. We thought you would be thankful that...

Read MoreExciting news! The MB Group has been included on Inc. magazine's Best Workplaces list. You can find us featured in the May/June 2022 issue or on Inc.com. This list is a comprehensive measurement of...

Read MoreAs an attorney, you specialize in matters of the law and in helping protect the rights of your clients. And while you may have been able to handle your bookkeeping and accounting in the beginning,...

Read More